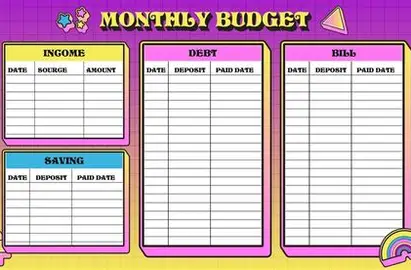

Managing finances effectively starts with a solid monthly budget. A well-planned budget helps you track expenses, save for goals, and avoid unnecessary debt. At EliteLearnX, we guide learners to develop practical financial habits that empower them to take control of their money.

1. Assess Your Income

The first step in creating a budget is understanding your total monthly income. Include all sources such as salary, freelance work, or passive income. Knowing your income sets the foundation for allocating funds effectively.

2. Track Your Expenses

Keep a record of all your expenses for a month. Categorize them into essentials (rent, utilities, groceries), non-essentials (entertainment, dining out), and savings or investments. This helps you identify where your money is going and areas where you can cut back.

3. Set Financial Goals

Define short-term and long-term financial goals. Whether it’s saving for an emergency fund, a new gadget, or investments, clear goals give purpose to your budget and motivate consistent saving.

4. Choose a Budgeting Method

Several budgeting methods can help you allocate your income effectively:

- 50/30/20 Rule: 50% for needs, 30% for wants, 20% for savings.

- Zero-Based Budgeting: Assign every rupee a purpose, ensuring no money goes untracked.

- Envelope System: Use separate accounts or envelopes for each category to control spending.

5. Adjust and Prioritize

Review your spending patterns and adjust your budget where necessary. Prioritize essentials and savings over non-essential expenses. Flexibility is key to ensure your budget remains realistic and sustainable.

6. Use Tools and Apps

Budgeting apps or spreadsheets can simplify the process, automate tracking, and provide insights into your spending patterns. Tools like Google Sheets, Mint, or YNAB (You Need a Budget) can help maintain consistency.

7. Review Monthly

A budget is not static. Review it monthly to track progress, adjust for changes in income or expenses, and ensure that it aligns with your financial goals. Continuous monitoring ensures your budget works effectively.

EliteLearnX – Build Smart Financial Habits

At EliteLearnX, we provide guidance and courses to help you develop practical financial skills. Learn how to create effective budgets, manage money wisely, and achieve your financial goals.